In March 2021, the art world was stunned when digital artist Beeple sold a JPG file for $69 million at Christie's auction house. The sale of "Everydays: The First 5000 Days" thrust non-fungible tokens (NFTs) into the mainstream consciousness and triggered a gold rush in digital art. Two years later, as the initial hype has settled into a more measured reality, it's time to assess how blockchain technology is genuinely transforming the art ecosystem and what the future holds for digital artists.

Beyond the Hype: NFTs in 2023

After the speculative bubble of 2021-2022, the NFT market has undergone a significant correction. According to data from NFT marketplace tracker NonFungible, trading volumes have decreased by over 90% from their peak. However, this market cooling has had a silver lining—it has cleared away much of the speculative froth and allowed more substantive applications to emerge.

"The crash was necessary and healthy," explains digital artist Sarah Kim, whose generative art collections have maintained their value despite market fluctuations. "During the peak, everyone was creating NFTs just to cash in. Now, the focus has returned to artistic merit and innovative use of the medium."

While headline-grabbing multimillion-dollar sales have become less common, the technology itself has matured. Platforms have improved their user experience, reduced environmental impacts through more efficient consensus mechanisms, and developed better tools for artists to protect and monetize their work.

A modern NFT marketplace interface with improved artist tools

New Models of Ownership and Patronage

Perhaps the most significant impact of blockchain technology on the art world has been the evolution of new ownership models. Smart contracts—self-executing agreements with terms written directly into code—have enabled artists to receive royalties from secondary sales, something that has been virtually impossible in the traditional art market.

"Before NFTs, I had no way to benefit when my early works increased in value," notes digital artist Marcos Rivera. "Now, I automatically receive 10% of the resale price whenever my pieces change hands. This creates a more sustainable long-term career path."

Beyond simple ownership, new models of fractional ownership and patronage have emerged. Art DAOs (Decentralized Autonomous Organizations) pool resources to acquire significant works and give members voting rights on acquisition decisions. Platforms like Artblocks allow collectors to support artists by minting generative art pieces that are created algorithmically at the moment of purchase, creating a unique collaboration between artist, algorithm, and collector.

Addressing Environmental Concerns

Early criticism of NFTs focused heavily on their environmental impact, particularly those minted on the Ethereum blockchain, which initially used an energy-intensive proof-of-work consensus mechanism. In response, the industry has made significant strides toward sustainability.

Ethereum's transition to proof-of-stake in 2022 (known as "The Merge") reduced its energy consumption by approximately 99.95%, addressing one of the most significant barriers to adoption for environmentally conscious artists and collectors.

"The environmental concerns were valid, and many artists, myself included, hesitated to enter the space because of them," says environmental artist Joanna Torres. "Ethereum's shift to proof-of-stake was a game-changer for me. Now I can explore blockchain technologies while staying aligned with my values."

Additionally, alternative platforms like Tezos and Flow have gained popularity specifically because of their lower environmental footprints, demonstrating that sustainability has become a competitive advantage in the blockchain art space.

Bridging Digital and Physical Art Worlds

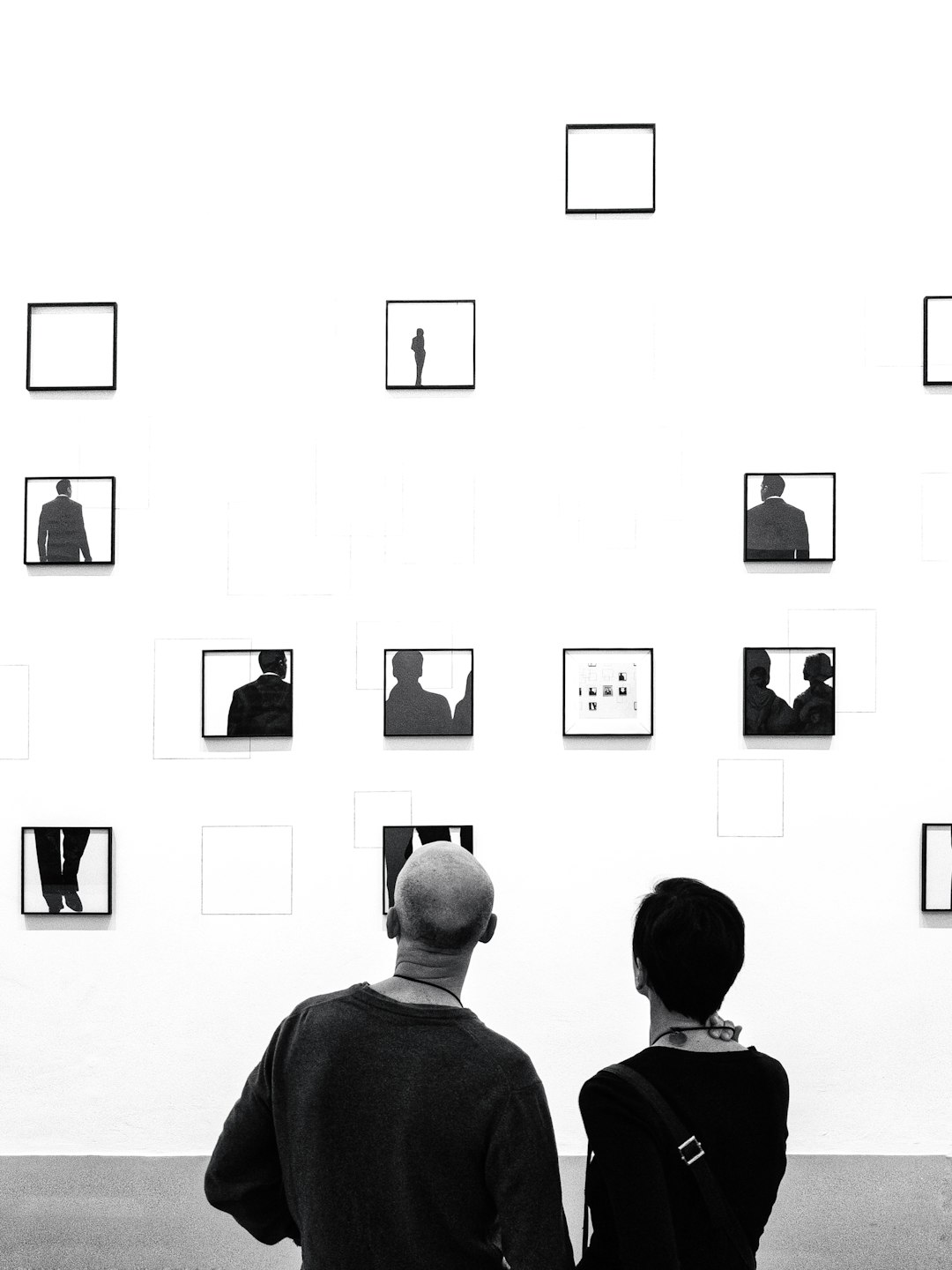

While early NFT discussions often positioned digital and physical art as opposing forces, 2023 has seen increasing integration between the two domains. Traditional galleries and museums have begun incorporating digital components into their exhibitions, while NFT platforms have developed ways to connect digital tokens with physical objects.

The Serpentine Gallery in London recently concluded "Future Frequencies," an exhibition that seamlessly blended physical installations with augmented reality components accessible through blockchain verification. Meanwhile, companies like Infinite Objects create physical displays specifically designed for digital art, allowing collectors to showcase their NFTs in tangible form.

A physical display frame for digital NFT artwork in a collector's home

"The false dichotomy between digital and physical is breaking down," observes curator Maria Hernandez. "The most interesting work happens at the intersection—where digital provenance enhances physical objects, or where physical experiences extend digital ownership."

Global Access and Emerging Markets

One of the most profound impacts of blockchain technology has been its ability to create a truly global art market, accessible to creators regardless of their geographic location or access to traditional art institutions.

Nigerian digital artist Ola Ademola exemplifies this democratizing potential. "Before NFTs, my options for reaching international collectors were extremely limited," he explains. "The traditional art world has significant barriers for artists from certain countries. Blockchain technology bypasses those gatekeepers and lets me connect directly with a global audience."

Art communities have flourished in regions traditionally underrepresented in the global art market. From Southeast Asia to Latin America, collectives of digital artists are building local ecosystems while accessing international markets through blockchain platforms.

This global accessibility extends to collectors as well. "I've sold works to collectors in over 30 countries," notes Australian artist Leah Chen. "Many of them have never purchased traditional art before. NFTs are bringing new participants into the art market who might have felt excluded from conventional galleries and auction houses."

Legal and Regulatory Evolution

As the digital art market matures, legal frameworks are evolving to address its unique characteristics. Copyright issues, taxation of digital assets, and regulatory compliance have become increasingly important considerations for artists and platforms alike.

"The legal landscape is still catching up to the technology," explains intellectual property attorney David Goldstein. "We're seeing interesting questions about copyright enforcement, the legal status of smart contracts, and how existing art market regulations apply to digital works."

Several countries, including Singapore and Switzerland, have developed clearer regulatory frameworks specifically addressing digital assets, providing safer environments for artists and collectors. Meanwhile, industry associations like the Digital Art Association have developed best practices and standards to promote transparency and ethical conduct.

The Future: Beyond Static Images

As we look to the future of digital art, the most exciting developments extend beyond static images to more complex and interactive experiences. Generative art, which uses algorithms to create works that evolve based on various inputs, has gained significant traction among collectors seeking unique, programmable experiences.

Artist Sofia Crespo's "Neural Zoo" project uses artificial intelligence to create imaginary creatures that evolve based on collector interaction, blurring the line between creator, artwork, and audience. Similarly, interactive environments in developing metaverse platforms offer new canvases for artistic expression that go beyond traditional viewing experiences.

"We're moving from art as object to art as experience," predicts digital artist and programmer Jake Liu. "The most innovative work happening now involves systems rather than static pieces—art that responds, evolves, and engages in dialogue with its audience."

Conclusion: A Maturing Ecosystem

The digital art revolution catalyzed by blockchain technology has moved beyond its initial speculative phase into a period of meaningful innovation and infrastructure building. While cryptocurrency prices and trading volumes will continue to fluctuate, the fundamental impact on how digital art is created, valued, and exchanged appears lasting.

For artists, the technology offers new avenues for monetization, protection of their work, and direct connection with audiences. For collectors, it provides verifiable ownership of digital assets, participation in artist success through secondary royalties, and access to emerging creative talents regardless of geographic borders.

As the technology continues to evolve and legal frameworks mature, we can expect the boundaries between digital and physical art to blur further, creating a more integrated and accessible global art ecosystem. The revolution may have begun with headline-grabbing sales, but its lasting impact will be measured in how it transforms the relationship between artists, audiences, and the very concept of creative ownership in the digital age.

Comments (4)

Alex Taylor

April 10, 2023 at 11:42 AMGreat analysis of where we are with NFTs in 2023. The hype cycle was inevitable, but I'm glad to see the focus returning to artistic merit rather than just speculation. The royalty aspect is truly revolutionary for digital artists.

Sophia Kim

April 11, 2023 at 3:05 PMAs someone who's been creating digital art for over a decade, the ability to establish provenance and ownership has been game-changing. I appreciate that this article acknowledges both the opportunities and challenges in the space.

Mark Johnson

April 12, 2023 at 9:17 AMI'm still skeptical about NFTs. Yes, they create digital scarcity, but I question whether that's actually necessary or beneficial for digital art. Isn't the infinitely reproducible nature of digital work part of what makes it special?

Leila Hernandez

April 13, 2023 at 5:40 PMThe environmental improvements are crucial. I refused to mint any work until Ethereum completed The Merge because I couldn't justify the carbon footprint. Now I'm cautiously exploring the space, though there's still work to be done on accessibility for artists without technical backgrounds.

Leave a Comment